TFC’s Distribution Days is upon us!

Next week, The Film Collaborative is holding a free virtual distribution conference, Distribution Days, which will offer concrete takeaways on the state of indie distribution and how filmmakers can navigate it. Attendees will hear from exhibitors, distributors, consultants, and filmmakers, some with case studies, as they describe and reflect on the landscape.

This conference hopes to help filmmakers develop critical thinking skills around distribution by looking at what is and what is not viable within a traditional distribution framework. It will also offer some alternative approaches. Willful blindness or a doomsday mindset are equally unproductive.

So, we are offering this pre-conference primer to set the tone, take stock of what myths are out there, and talk about what thought leaders in this space are coming up with as ways to deal with the current landscape.

Here we go!

Remember the days when creators and distributors were lying back in their easy chairs, proclaiming their satisfaction with how independent cinema has been evaluated by the marketplace? Yeah, we don’t either…and we’ve been in the industry (in the U.S.) for more than two decades. Nevertheless, there is a pervading sense that the state of independent film has never been worse—and that we’ve been going downhill from this mythic “better place” ever since Sundance was founded in 1978.

Why do we insist on bemoaning a Paradise Lost when the truth is that being a filmmaker has never been a paradise? Filmmakers have always been confronted with predatory distributors, dense and confusing contract language, onerous term lengths, noncollaborative partners, lack of transparency, and anemic support, if any (just to name a few). For an industry that prides itself on creating and shaping stories that speak to diverse audiences, we should be better at articulating truer narratives about our field.

It doesn’t help that, at Sundance this past year, all one could talk about was how streamers were “less interested in independent film than a few years ago, preferring [instead] to fund movie production internally or lean on movies that they’ve licensed” and how Sundance itself was “financially struggling, presenting fewer films than in previous years and using fewer venues.” (https://www.thewrap.com/sundance-indie-film-struggles-working-business-model) Still others like Megan Gilbride and Rebecca Green in their Dear Producer blog have put forth ideas how Sundance should be reinvented completely.

But we all know that independent film isn’t just about Sundance. We have heard a lot of discussion recently about the need to reshape the narratives we tell ourselves regarding the state of the independent film industry.

Distribution Advocates, which is also doing great work chasing the myths vs. the realities of the field, also believes that we must all question “some of our deepest-held beliefs about how independent films get made and released, and who profits from them.”

In their podcast episode about Exhibition, economist Matt Stoller remarked how “weird” it is that even with all the technology we possess connect audiences, we’re still so “atomized” that all that rises to the top is whatever appears in the algorithm Netflix chooses for us in the first few lines of key art when we log in (and we will note that even the version of the key art you see is itself based on an algorithm).

But is it really all that strange? One of the main reasons that myths exist is that someone is profiting from perpetuating them. The same with networks and platforms and algorithms. And the more layers of middlemen and gatekeepers there are, the harder it is for us to see the forest for the trees. Keeping us in our algorithmically determined silos numbs us into not minding (actually preferring) that we are watching things—or bingeing things—from the safety and comfort of our living rooms. The ability to discover on our own content that aligns with our true interests or consuming content in a communal space has disappeared the same way that the act of handwriting has…we used to be able to do it but haven’t done it in so long that it feels unnatural and too time-consuming to deal with.

Brian Newman / Sub-Genre Media acknowledges that the problems remain real, but that what everyone is calling crisis levels seems to him merely a return to norms that were in place before the bubble burst. No one, he says, is coming to rescue “independent film”—certainly not the streaming platforms, which merely used it as necessary to build a consumer base.

Many have posited myriad ideas about how to bypass the gatekeepers. Newman echoed what TFC has been recently discussion internally: that instead of many competing ideas, we need them to be merged into one bigger idea/solution. Like, for example, an overarching solution layer run by a nonprofit on top of each public exhibition avenue that will aggregate data and help filmmakers connect audiences to their content. A similar idea was also discussed at the last meeting of the Filmmaker Distribution Collective in the context of getting audiences into theaters.

By exclaiming that “No one is coming to the rescue,” Brian really means that we are all in this together, and that it’s going to take a village.

We agree, but a finer point needs to be made.

Every choice we make moving forward—whether you are a filmmaker, distributor, theater owner, or festival programmer, what have you—could possibly be distilled into either a decision for the independent filmmaking public good…or for one’s own professional interest. Saying that a non-profit should come in and offer a solution layer to aggregate data is all well and good until it threatens to put out of business someone whose livelihood is based on acquiring and trafficking in that data. How refreshing was it to be reminded at Getting Real by Mads K. Mikkelsen of CPH:DOX that his festival has no World Premiere requirements? It reminds us of the horrible posturing and gatekeeping film festivals do in the name of remaining relevant and innovative. For us to truly grow out of the predicament we are in, some of us are going to have to voluntarily release some of the controls to which we are so tightly clutching.

Keri Putnam & Barbara Twist have an excellent presentation on the progress of a dataset they are putting together of who is watching documentaries from 2017 – 2022. They provide some other data that was very sobering:

Film festivals: comparing 2019 numbers to 2023 – there was a 40% drop in attendance;

Theatrical: most docs are not released in theaters and attendance is down even for those that are released.

But they also note that there is really great work being done in the non-theatrical space— community centers, museums, libraries – that is not tracked by data. TFC’s Distribution Days offers two sessions on event theatrical and impact distribution, so we’ll be able to see a tiny bit of that data during the conference.

We also know that the educational market is still healthy, and that so many have remarked of the importance of getting young people interested in film…so we have three sessions where we hear from the Acquisitions Directors of 11 different educational distributors.

We also have a panel from folks in the EU who will provide advice on the landscape and how best to exploit films internationally and carve our rights and territories per partner. And we’ll speak to all-rights distributors about what kinds of films they see doing well, what they are doing to support filmmakers—and what their value proposition is in this marketplace.

We have a great panel on accessibility, and two others that relate to festivals and legal agreements.

Starting off with a keynote from noted distribution consultant and impact strategist Mia Bruno, the 2-day conference aims to summarize the state of the industry while providing thought provoking conversations to inspire disruption, facilitate effective collaboration, and to aid broken hearts.

Regardless of whether current days are better or worse than the heydays of Sundance and the independent film of yesteryear, Distribution Days will identify the current obstacles of the independent film distribution landscape, and what we can hold on to—as a commonality—to evolve the landscape together in the future.

If you look a little deeper, you will see that, despite all the challenges, filmmakers have and can still achieve “success” when they understand the terrain, (sometimes) work with multiple partners with a bifurcated strategy, protect themselves contractually, and maintain and grow their own personal audience.

We hope you will join us. And for those of you that cannot make all of the sessions we are offering live on May 2 & 3, you’ll be able to catch up on what you missed via The Film Collaborative website after the conference is over.

We look forward to seeing you next week! And if you have not registered yet, you can do so for free at this link.

David Averbach April 25th, 2024

Posted In: case studies, Digital Distribution, Distribution, Distribution Platforms, DIY, Documentaries, education, Film Festivals, International Sales, Legal, Marketing, Theatrical

The Implosion of Distributor Passion River… And What it Means for You

by Pat Murphy

Pat Murphy is a documentary filmmaker and editor. His latest film, Psychedelia, uncovers the history and resurgence of psychedelic research. It was sold to universities, nonprofits, international broadcasters, and the streaming service Gaia.

Passion River Films was one of those rare distributors. In an industry with plenty of shady companies, they had a reputation for honesty. Some of the most influential figures in the independent documentary distribution space referred their colleagues to them. And yet under the hood, in that nondescript office building in New Jersey, the operation at Passion River was in serious trouble. And it had been for some time.

Founded in 1998 by Allen Chou, Passion River’s catalog focused on educational documentaries, which they sold to universities, libraries, nonprofits, and the DVD/VOD market. Unlike a lot of distributors, they were flexible with filmmakers. They allowed them to put a cap on distribution expenses and reserve certain rights for themselves. I signed my film Psychedelia with them in 2021 and got the feeling that it was in good hands.

Yet for the past few years, Passion River had been withholding accounting reports and payments to filmmakers. Communication slowly dropped off and eventually went completely silent. Requests for information were ignored. And then earlier this year, they announced—in an unexpected, evasive, and self-serving manner—that they were insolvent. Hundreds of filmmakers lost many thousands of dollars, and some are still dealing with the logistical nightmare it caused for their films.

What happened at Passion River? How did it slip by undetected? We may never know. But Passion River’s collapse should serve as a stark warning to all filmmakers of the precarious nature of film distribution. It comes during a tumultuous time for the industry and the larger economy. It’s a bombshell story that demonstrates the inadequacy of systems to deal with this situation. And it shows how the hardship lands squarely on the creatives who make this industry possible.

What We Know

If you’re pressed for time, here’s a summary of the situation:

- In January, Passion River announced that they had become insolvent, and were selling the “majority of their assets” to another distributor called BayView Entertainment.

- Once filmmakers were connected with BayView, they were told that they had purchased the “assets, but not the liabilities” of Passion River.

- Passion River had been withholding accounting statements and payments to producers in 2022 and earlier, leaving producers without any record of the money they were owed. BayView said they were not responsible for these payments.

- Filmmakers had nobody to contact. Passion River abandoned its offices, shut down their phone lines and email domains, and transitioned their employees to new positions at BayView.

- The total damage in lost payments, although difficult to determine, is likely in the multiple six figures. There appears to be no accountability on the part of Passion River.

Keep reading to get the full story, as well as distribution strategist Peter Broderick’s key takeaway.

Announcing Their Insolvency

On January 31, 2023, Josh Levin (Head of Sales and Acquisitions at Passion River), sent the following note to most (but not all) of the filmmakers that had contracts with the company:

I have some news to share – the parent company of Passion River Films lost the ability to meet its obligations and has sold the majority of its Passion River assets to BayView Entertainment, LLC. BayView is a venerable, much larger film distributor with an outstanding 20+ year reputation in film distribution.

I am sure you have questions about what this transition means for you and your films. These questions can best be answered by speaking directly with Peter Castro, the VP of Acquisitions at BayView. Please email Peter at ***** to set up a call. Peter is looking forward to speaking with you.

According to their contract with filmmakers, Passion River was supposed to send accounting statements and payment 60 days after the end of each quarter. This meant that all sales that Passion River made in the fourth quarter of 2022 (October-December) were supposed to be reported and paid by March 1, 2023.

This timing was particularly unfortunate for me and my film, which had been released in Summer 2022. We secured a streaming deal with Gaia and it was released on TVOD. Gaia pays their licensing fee in two installments. So, I was waiting on the second payment ($9,750) plus all the TVOD and educational sales from my film’s release. Those payments came in the fourth quarter 2022, so I was waiting for that statement and payment to come by March 1, 2023.

Naively, I responded by asking Josh Levin about his own well-being. While I found Passion River’s work a bit sloppy and frustrating, I took Josh to be an honest broker. I was relieved to hear that he was going to work for BayView as Vice President of Sales [LinkedIn account required to view]. To me, the whole thing was portrayed as a standard acquisition. I thought that I would work with Josh as before, but this time under a new company name. I assumed my payment of over $10,000 would come from the new company.

But by the time I was able to get through to Peter Castro (VP of Acquisitions at BayView), it was already March 3, 2023. Neither my accounting statement nor my payment had arrived. My conversation with Peter turned out to be extremely unsettling. This was no ordinary acquisition. BayView had purchased the “assets but not the liabilities” of Passion River.

Yes, that’s a thing. Apparently BayView did not actually purchase the rights to our films, and therefore they were not responsible for any outstanding payments from Passion River. And they had no way of collecting that money or telling us what happened to it. We had the option to sign new contracts with them, at a less favorable split than we had with Passion River.

As for getting answers on what happened over at Passion River, such as why they became insolvent or what they did with the money that was due to us? There was no avenue to explore those questions. Josh Levin, now employed by BayView, said he was forbidden to talk about anything that happened at Passion River. Allen Chou, the president of Passion River, whom most people had never met, was elusive. The voicemail boxes at Passion River were full and their email domains would bounce.

I was devastated. And furious. Like most folks, my film was an independent labor of love over several years. What made it sting even more was the fact that Passion River did not actually secure my streaming deal with Gaia. Gaia heard about my film through my own marketing efforts, and as a good faith move towards Josh Levin, I decided to give Passion River their 25% commission on that deal.

As it turns out, I was not alone.

Finding the Others

Without any helpful information, we began finding each other through online forums like The D-Word and the Facebook group, Protect Yourself from Predatory Film Distributors [Facebook account required and one must join the group to view]. Eventually, we gathered on a private channel, so we could share information and piece together whatever we could from our own investigations and experiences.

Each film’s situation was different, but pretty much everybody reported the same experience working with Passion River: disorganized workflows, poor communication, improper accounting, missed payments, and even downright deception.

Filmmaker Jacob Bricca of Finding Tatanka said, “They were responsive at first, informing me of sales they had made and giving me regular statements showing that I was slowly paying off the charges associated with creating the DVD and distributing the film. This communication dropped off as the years went on. I finally contacted them again in mid 2022. These inquiries went unanswered. Finally, after repeated attempts to get a reply, I got a statement in early 2023 that I was owed over $1,400… I have never seen a penny from Passion River.”

Jacob was the only filmmaker I ever spoke to that had received an accounting statement for the fourth quarter of 2022. The rest of the filmmakers did not receive any accounting statements for that quarter, leaving them without a written document of what they were owed. Many reported incomplete accounting prior to the 4th quarter as well. Time and again, filmmakers were told by Josh Levin that he would “ping accounting” about their issue. However, filmmakers received no response or follow through.

While all this was happening, Passion River was still actively marketing their catalog. In March of 2023, I found an End of the Semester Sale on their website, which was active from December 1, 2022 to January 31, 2023. My film was featured prominently on the page, even though I had never received a single report of an educational sale. The fact that they would deliberately run a sale as late as December (when the sale to BayView must have been known), raises serious ethical questions.

“Passion River is not the first, or last, film company to go out of business,” said Emmy-and Peabody-winning and Oscar-nominated producer Amy Hobby. “But the lack of transparency, failed reporting, and missed payments simultaneous to continued recoupment off filmmakers’ backs is egregiously unethical.”

Attempts at a Resolution

Besides dealing with the financial fallout from Passion River, our other big question was about what to do with our films moving forward. They were still up on VOD platforms, but where was that money going? And what do we do now that we don’t have a distributor?

Director Kim Laureen, of Selfless, signed with Passion River in 2020: “Since day one I have had to chase reports and payments.” Unlike me, she was never notified of the sale to BayView. With nobody to contact about her pending payments, Kim sent a tweet out to Passion River. That got the attention of Peter Castro, VP of Acquisitions at BayView. Kim had a conversation with Peter, in which she explained why people were frustrated. Peter agreed to host a Zoom call with Kim and any other filmmaker who felt mistreated. Kim and I put out notices to the group of filmmakers about a “virtual town hall” on March 17, 2023.

Peter must have been surprised when he logged on to zoom and found dozens of angry filmmakers asking tough questions and demanding answers. Consultant Jon Reiss also joined and was instrumental in getting straight answers. The conversation went on for almost an hour and a half. We were able to confirm the following during that meeting:

- It’s unclear exactly what BayView purchased from Passion River, but it allowed them to collect revenue off of our films without a contract.

- Since BayView was currently collecting revenue on our films, they would send us payment for 2023 sales whether or not we signed new contracts with them.

- For those of us who wanted to move on to new distributors, BayView would facilitate that.

It sounds like many people ended up signing with BayView. But most of the people I’ve spoken to decided to move on to new distributors or go a DIY route without any distributor. Figuring out how to do all this and getting Allen Chou to cooperate was full of complexities over the ensuing months:

- Many distributors required an official release from Passion River. Through a collective effort led by producer Amy Hobby, Allen Chou wrote an official letter on May 9, 2023. This was his first communication to us, more than four months after the transition.

- Passion River had used an aggregator called Filmhub to upload many of our films to TVOD platforms. We were able to transition accounts with a representative there. In this scenario, the filmmaker keeps 80% of TVOD revenue, rather than giving Passion River or BayView their commission.

- BayView sent us accounting statements for Q1, as promised, on May 15, 2023.

Legal Recourse

One of the biggest revelations for me was the inadequacy of the legal system to deal with this situation. When I signed my deal with Passion River, I went back and forth on the legal language endlessly. I did everything I thought I could to protect myself and spent thousands of dollars in legal fees to do so. And when Passion River blatantly breached the contract? There was no good answer on what to do.

One avenue the legal system provides is small claims court. It’s designed to get your case heard in front of a judge without the need for an attorney. One filmmaker, who wishes to remain anonymous, decided to go this route. Their lawyer told them it was a “clear-cut case.” The filmmaker and their partner had painstakingly put together a Statement of Reasons, outlining their relationship with Passion River and what they were owed. In New Jersey, the maximum allowance is $5K.

Small claims court was on Zoom, and Allen Chou was there with his attorney, Spencer B Robbins. When it came time to present, Robbins interjected with an arbitration clause that was in Passion River’s contract, stating that any dispute between the parties should be brought in front of an arbitrator. With that, the judge threw out the case. The filmmakers tried to make a rebuttal but felt they were not given a proper chance to speak.

The filmmakers were so distraught that they decided to cut their losses and move on. “It’s why people lose faith in the justice system,” said one of them. While it’s difficult to say how much Passion River withheld from filmmakers, we can make a general estimate. Passion River had around 400 films in their catalog. So even if each film was only owed $1k that would aggregate to $400k. Almost half a million dollars. Where all that money went remains unknown. And as far as we can tell, nobody involved has been held accountable.

Key Takeaways

Here we are almost a year later. Many have expressed anger and depressed feelings around the whole situation. Writing this article has brought up a lot of emotions. But it’s also made me determined to not give in to cynicism. We need to turn this awful situation into something productive. In an attempt to do so, the following are some key takeaways from the experience.

1) The Importance of Due Diligence

“The best way that independent filmmakers can protect themselves from bad distributors is to do due diligence,” said distribution strategist Peter Broderick. “Due diligence should involve speaking to 3-5 filmmakers who are currently, or recently, in business with that distributor. The filmmaker should not ask the distributor for referrals, they should look up which films the company is working with and have confidential conversations with them about their experience. Is the distributor sending reports regularly and paying on time? Are they easily accessible to their filmmakers? Have the results matched the expectations created by the distributor? If the filmmaker isn’t comfortable sharing numbers, that’s fine. You just need a clear sense of whether working with this distributor is an opportunity or could be a disaster.”

It’s true that if I had done proper due diligence in 2021, when I was considering signing with Passion River, I probably would have avoided disaster. It seems that Passion River had been withholding payments even back then. But we also need some sort of institution where we can centralize our experience and knowledge around distributors. The issue is that everybody exists in their own silo and they don’t speak up out of fear. We need some sort of centralized way to create accountability.

2) The Filmmaker Suffers Most

It’s clear that the filmmakers bore the brunt of this entire fiasco. We were the ones who invested in our films. We are the ones who suffered the financial fallout. The employees at Passion River got new positions at BayView. Josh Levin maintains a faculty position at American University. There’s not much revenue in independent documentaries, and there is a layer of professionals who scrape whatever exists up top, leaving little to nothing for the filmmaker. So be careful where you spend your resources.

3) A Warning of What’s Ahead

The collapse of Passion River happened at an uncertain time for the industry at large. 2023 started off with the Sundance Film Festival, which saw the worst sales of documentaries in years. There will continue to be more disruptions as new technology and viewing habits change the way films are made and seen. This is also happening in a tumultuous macroeconomic environment. I would not be surprised if more distributors start to become insolvent or if they sell off their assets in the same manner Passion River did. In fact, there’s a thread on the Protect Yourself Facebook Group [Facebook account required and one must join the group to view] about filmmakers not getting paid by 1091 Pictures. If you have a contract with a film distributor, be on high alert. Stay on top of payments and reports. Ask the difficult questions. Be vigilant. If Passion River gets away with all of this, it could become a blueprint for other distributors to follow.

Thank you for reading. If you have any questions or comments, please reach out to me at pat@hardrainfilms.com.

admin October 31st, 2023

Posted In: Distribution, DIY, Documentaries, Facebook, Legal

All About AVOD? part 1: What To Do with Your Library Title

by David Averbach and Orly Ravid

One of the joys of working at The Film Collaborative is our extended filmmaker family. Some of the filmmakers we work with we have known for decades, back to when they made their first films. Inevitably, after seven-, ten-, or twelve-year terms, many of these filmmakers are getting their rights back from the distributors with whom they originally entered distribution deals.

They often ask us, “What is possible for my film now? What can I do to give it a second life?”

(We should state that the vast majority of these filmmakers do not have obviously commercial projects that could simply be offered to a different large streaming service like Netflix or Hulu. They are the type of films that TFC handles: solid films with good or at least decent festival pedigrees and proper distribution at the time of their initial release.)

Unfortunately, there is no one answer for every film. Nor is there a fixed answer for each type of film, as platforms’ needs can change at the drop of a hat. Except that all platforms seem to have an endless appetite for true crime docs, but we digress…

So, this blog article is less of a “how to” for library titles, and more of a “how to think” about them.

Certainly, there are non-exclusive subscription-based (SVOD) platforms that align with various content areas, such as Documentary+, Topic, Wondrium, Curiosity Stream, Coda, Qello, Tastemade, Gaia, Revry, and many more (check out our Digital Distribution Guide for more info). These are platforms that offer a revenue share based on minutes watched. Since they may have not been in existence when the filmmakers’ original distribution deals were arranged, they are definitely worth exploring when one (or more) of them is a fit for your project.

But there are also ad-supported (AVOD) platforms1, which are free to the end user and rely on commercials that play before the film starts. Generally speaking, AVOD platforms seem to be more lucrative in terms of revenue than specialized SVOD platforms, and we’ve heard that some films are making “real” money them (more on that later). While there’s no guarantee that AVOD platforms will bring in more money than SVOD platforms, or much money at all, this at least makes sense, anecdotally: with the rise in commercial streaming services and especially since the start of the pandemic, folks are watching increasingly more content, but actually spending less above and beyond the Netflix/Amazon Prime/HBO/Disney etc. combination of platforms that they have ostensibly come to view as basic utilities.2 So AVOD provides a win-win for platforms and consumers alike.

Until recently, filmmakers have been somewhat reluctant to place their films on AVOD platforms, but they are coming to realize what distributors have known for a few years now—that AVOD can continue to bring in revenue when transactional platforms such as iTunes are no longer performing for a film the way they might have at the beginning of their digital run.

So, we set out to ask what we believed was a simple question: which AVOD platforms are taking which type of library content? The Film Collaborative has some limited experience with AVOD platforms, but we felt it prudent to talk to some folks that do this day in and day out. To that end, we reached out to Nick Savva, Vice President of Content Distribution at Giant Pictures, and Tristan Gregson, Director of Licensing & Distribution at BitMAX.

The answer turns out to be a complicated one. Here’s why:

Most AVOD platforms are looking for all kinds of content. One of the trends that has been occurring for the past few years is the addition of new platforms, not just in the U.S., but globally. And the pandemic has accelerated existing trends, so there are even more new platforms than ever. These platforms are not going to be able to produce or acquire enough new content to justify their existence, so they rely on library titles as much as they do new releases. So, the good news is that there are more outlets and revenue opportunities for library titles than ever.

The not-so-great news is that sometimes AVOD platforms are actually looking for specific types of films, but only for a limited time to fill a specific need. Platforms have a good sense of what percentage of their films are, for example, comedies, dramas, thrillers, horror, documentaries, true crime, etc. When they look at who is watching what, if comedies are overperforming on the platform relative to the percentage of titles they occupy overall, the platform may not take as many comedies for a while until that changes, or they could decide to double down and take more comedies at the expense of other types of films. Conversely, if there is a category that is underperforming, they could decide that they need some fresh meat in that category, or simply decide to take less of it.3

So why exactly is this bad news? Because as the needs of AVOD platforms ebb and flow, the entities with the best chance of succeeding are those that can respond quickly to calls from these platforms for specific content. A high percentage of the work Giant Pictures does with AVOD platforms involves their distributor clients, who use Giant as a sort of white label service. Giant is tasked with placing their content libraries on these platforms because these distributors don’t have the bandwidth to keep up with which platforms want what from month to month. Similarly, BitMAX works with many studios to deliver to these platforms, but the studios are the ones handling the licensing. What this means is that the bulk of content going to AVOD platforms is coming from the content libraries of studios and distributors. That is not to say that films from individual filmmakers aren’t being placed on AVOD platforms by Giant/BitMAX, it’s just that studios and distributors are their go-to sources for content because they can provide a bunch of titles with a quick turnaround.

The sad reality here is that AVOD is one area of distribution where middlemen are being added to the mix in a way that makes it harder for individual filmmakers to take back control of their films.

Many of the filmmakers who have just gotten their rights back often remark to us how glad they are to have done so, as if they are finally getting out of a bad marriage. Even if the relationship wasn’t such a badmarriage, this sentiment—justified or not—perhaps stems from the fact that their TVOD sales had dropped over the years and they felt like their distributor was no longer doing anything for their film, or that they were tired of not receiving reporting because there were long periods of time with no earnings. The last thing they appear to want to do is start up a new relationship with a new distributor or aggregator and incur more encoding costs for a shot in the dark in terms of being accepted by these platforms only to earn $12 a quarter in earnings.

It’s important to really have a look at the reporting your old distributor provided you. There’s a good chance that simply re-creating what your old distributor did—perhaps your film was already on AVOD platforms—is going to give you a completely different outcome. But to the extent that your project has not been tested in the current landscape, what should a filmmaker be thinking about if they find themselves in the position of deciding whether to go it alone or offer their film to another distributor?

It’s Your Time and Money

Bandwidth:

Tristan Gregson remarked that the same rules apply for library titles as when just starting out, and his stance was the following: if you know how to engage your audience then put it somewhere. If not, then don’t. Whether you try to go it on your own or partner with another distributor, unless there is someone that’s going to remind your audience that it’s there, there’s a good chance your film will sit unnoticed in a glut of content. This is going to take some effort and while a new distributor might do a bit of marketing, you are going to have to get creative. Perhaps time the re-release of this older film with a new project of yours?

Cost:

If you go through an aggregator like BitMAX, you are probably looking at a bare minimum of $2,000 for encoding, QC, and delivery and to pitch and deliver to a few SVOD or AVOD platforms. It’s a fee for service, so they will be hands off when it comes to strategy, and uninvolved when it comes to your earnings. If a distributor like Giant Pictures is willing to work with you, it can cost twice that much, but they will be real partners in the sense that they will be proactive in helping you come up with a strategy. They will also take a certain percentage of your earnings. You may also be able to negotiate lower encoding costs in exchange for an increased percentage of your earnings.

What is in it for the Platform?

Metrics:

Nick Savva advises filmmakers to think about your film like a platform would: what are your film’s metrics? These scores can tell a lot about the public’s level of familiarity with your film, and there are data tracking services that distributors and platforms use to determine them. Also among the first things that an acquisitions team would look at would be indications of basic audience awareness, such as the of the number of positive reviews on Amazon, or the ratings on IMDb. If the metrics are good, a deal might be attractive to a platform. Are there any recent reviews? In other words, does your film still hold up?

Is there one Platform that is better for my film than others?

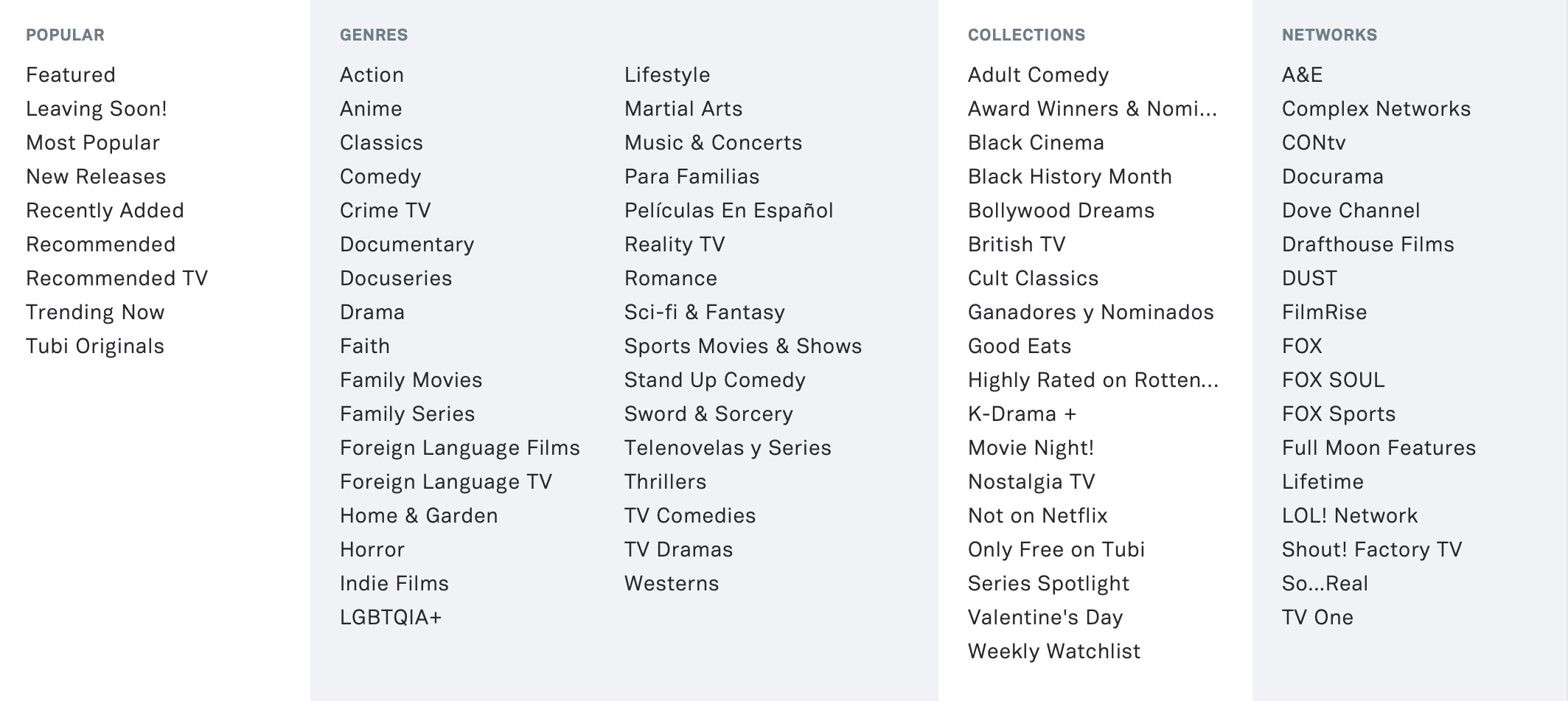

Honestly, there are not all that many AVOD platforms in the U.S. Tubi, Pluto, Roku, Peacock, IMDb TV, and a few others. The good thing about AVOD is that most deals are non-exclusive, meaning that you can be on more than one at once. But should you apply for all of them? How does one decide?

Signal Boost:

The following might not be possible for every film, but, if possible, try to think about the likely television habits of your audience and the specifics of each platform and take advantage of the free signal boost.

People are very familiar with platforms like Netflix and Hulu, but when it comes to platforms like Tubi or Pluto, why would one choose to watch one over the other? The answer might be simpler than you would think!

Does your film have a TV star in it? If they are on the FOX network, chances are that audiences will see ads for Tubi, because Fox is the parent company of Tubi. If they are on NBC, then perhaps Peacock or Xumo will be advertised.

There are also tricks that might apply for documentaries too. Pluto just became available in Latin America and Mexico, so films with Latinx content might want to consider that platform first.

One of The Film Collaborative’s digital distribution titles, The Green Girl, has been doing extremely well on Pluto, but not so well on Tubi or Roku, and for the longest time we couldn’t figure out why. Then it hit us: this documentary is about an actress who famously appeared on the 1960s television show Star Trek. Since Pluto is owned by Viacom, which is the parent company of Paramount, Pluto is the AVOD destination platform for Trekkies!

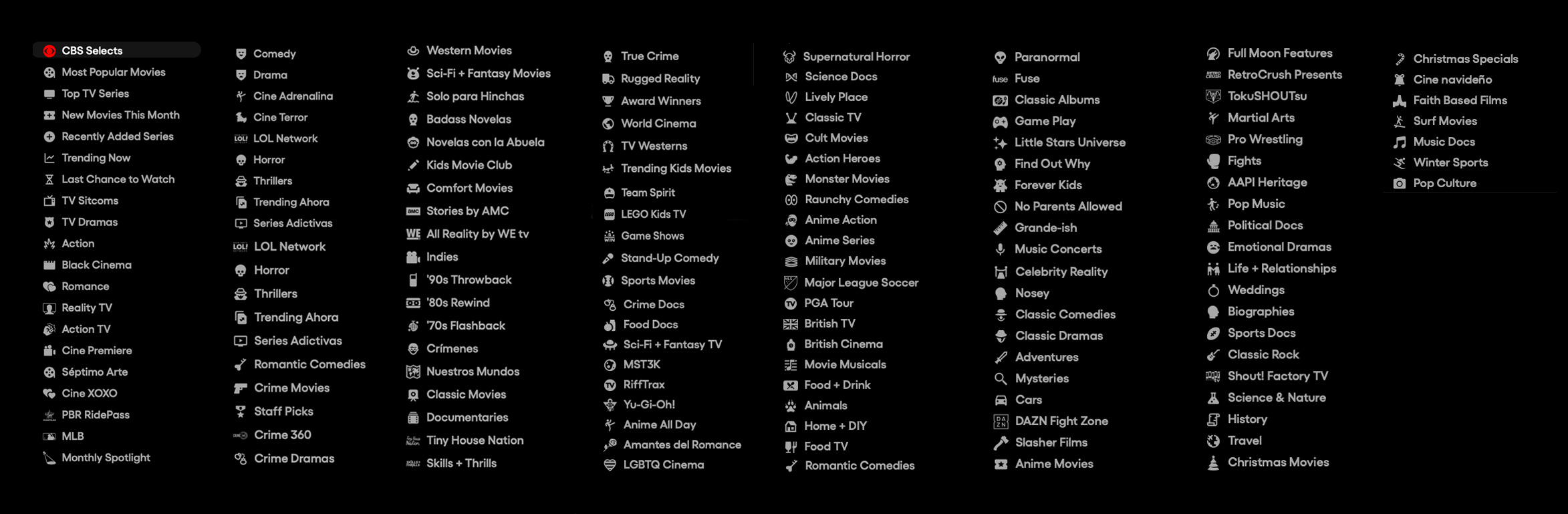

Keywords:

Make sure your keyword game is strong. Aggregators and distributors will ask you to fill out a metadata sheet with genres/keywords, but you must make sure the choices conform to actual categories and genres on the platforms, which can differ from one another and evolve over time. Distributors have even admitted that it’s hard for them to keep up sometimes, especially if such metadata is capture via web interface. Case in point: The Film Collaborative placed a few films we have been working with for years onto Tubi, but the keywords that we chose when we first submitted the film to our aggregator were based on iTunes genres, which are very narrow. Cut to the films getting up onto Tubi, and they were almost impossible to find without searching for their exact titles. It’s been several months, and we are still struggling, with the help of our aggregator, to get these updated on the platform. Bottom line is that it’s important to be familiar with each platform and know how one might best search for your film and be proactive to ensure that the proper information is being delivered to each platform at the time of delivery.

Pluto TV (owned by CBS/Viacom) offers a dizzying array of genres/categories to choose from (they appear in a vertical sidebar and seem to rearrange themselves periodically)

Tubi’s current “Browse” navigation tab. Tubi’s parent company is Fox Corporation.

Very Mini Library Titles Case Study

We talked to director/producer Kim Furst, whose rights to her 2014 film Flying the Feathered Edge: The Bob Hoover Project came back to her after her aggregator (Juice) declined to renew the term. She expressed that she did not want to use another aggregator like Distribber/Quiver/Bitmax/FilmHub because there was a concern that they might not be around in another 5 years. (As you probably are aware, Distribber has shuttered, and Quiver is not currently accepting films from individual filmmakers and will probably turn into something else).

So, she went with Giant Pictures.

The cost to re-encode was about $4K. While she did not feel great about having to shell out such a huge chunk of cash on a library title, Kim still felt that the film still had life in it, and she wanted to try other distribution avenues, such as public television, that she never managed to do when the film originally came out.

We should note that one of the reasons why Giant might have been interested in the film was that it is narrated by Harrison Ford. The film is about Bob Hoover, an American fighter pilot and air show aviator, and Ford has a longstanding love of flying planes. So, there is some commercial appeal that can be leveraged here.

She is at the stage where they have initiated the re-release. Right now, the film is back up on TVOD platforms, including being re-placed on Amazon, which Giant was able to accomplish despite the platform’s embargo on unsolicited non-fiction content.

We asked Kim to report back on what happens next. We suggested that she note where all of Harrison Ford’s top movies are on AVOD and take note if that platform sees any boost from the connection.

Revenue Range

With so many variables and permutations, it’s hard to give a real range in terms of what’s possible for a library title on AVOD, especially since it’s impossible to know when we are talking about the revenue of a “library” title—as opposed to that of a title that enters AVOD as part of their “new release” window.

When I asked Tristan about revenue, he acknowledged that to even talk about it would put us into “anecdotal space,” because he isn’t aware of what it took for some of his clients to earn, for example, 5 figures during an AVOD revenue period, as compared with other clients who were only able to earn, say, 3 figures. While he admitted that he has seen a single independent film title clear quite a bit, he also reiterated to me that at a certain point of revenue generation, distributors tend to get involved with a title to signal boost, so it isn’t exactly “a fair comparison to those independents working day in and day out to make a few grand on their title. But if the message is that you don’t have to be working with one of the major studios to reach seven figures in revenue, it can still very much be accomplished in this current age of VOD releasing.”

Nick spoke more specifically to AVOD, noting that they “have had a couple of indie titles which have generated $100k+ royalties in 1 month on 1 AVOD platform. But, of course, those are outliers.”

One of our filmmakers told us that they have two filmmaker friends-of-friends (whose films deal with Black Cinema content) for whom Tubi is paying well: one reported $15K a month in residuals while the other one says they are making $4-6K a month on a movie released 10 years ago. Both filmmakers allegedly went through an aggregator, but their friend said they were reluctant to allow the names of their respective films to be shared publicly.

So, as Tristan remarked, it’s best not to hold too tightly onto evidence that is merely anecdotal, because TFC certainly knows films that are making almost nothing on AVOD.

Notes:

1. As we were conceiving this article on Library titles, and realizing how important AVOD could be for an older title, Tiffany Pritchard of Filmmaker Magazine approached us about an article she and Scott Macaulay were writing about AVOD. Its title is Commercial Breaks and it is available in the January 2022 issue of the magazine (behind paywall, at least for now).

2. As a reference, this article discusses how shorter theatrical windows might be accelerating TVOD decline and shows the increase in both spending and subscription stream share from 2019 to 2021. Others, however, predict that streaming services will lose a lot of subscribers in 2022. Still, it’s hard to know how streaming services are faring, as many of them are not transparent in their total number of subscribers and average revenue per year.

3. Stephen Follows assembled a team, called VOD Clickstream, that uses clickstream data to analyze viewing patterns on Netflix between January 2016 and June 2019. He also offers a ton of information on his website. In November 2020, he presented a talk entitled, “Calculating What Types of Film and TV Content Perform Best on SVOD?”, in which he outlined how he believed Netflix navigates how popular a genre is versus what percentage of content of that genre is available on the platform.

David Averbach February 8th, 2022

Posted In: Digital Distribution, Distribution, Distribution Platforms, DIY, Documentaries, technology

VOD Distribution in India + New Blockchain Distribution Platform/Service

by Orly Ravid

After participating in the Film Bazaar market in India (connected to the International Film Festival of India, now in Goa), I decided to investigate the distribution potential in India, specifically VOD and Blockchain and the distribution potential for independent cinema.

After participating in the Film Bazaar market in India (connected to the International Film Festival of India, now in Goa), I decided to investigate the distribution potential in India, specifically VOD and Blockchain and the distribution potential for independent cinema.

A 2018 report in Business Today noted that the OTT market in India is worth ½ billion and will grow to be 5 billion by 2023 with Fox’s Hotstar leading with 75 million subscribers with American companies such as Netflix and Amazon in hot pursuit. The reason for the growth is rising affluence and adoption across demographics including in rural areas. Today, the VOD market is AVOD-dominated but Business Today anticipates a flip with AVOD going down and SVOD and TVOD doubling from their present estimated 18% of the market.

This is fun—search “Film distribution in India” on Google and you get a nice scroll of logos with links to a bunch of companies. And you can find a list on Wikipedia.

At Film Bazaar I interviewed a couple of top players in the VOD distribution space, and also MinersINC, a new Blockchain distribution platform/service.

First, I spoke to Ajay Chacko is Co-founder & CEO of Arré, one of the country’s foremost original digital content brands. Arré was founded in 2015 by B. Saikumar, Ajay Chacko & Sanjay Ray Chaudhuri. Arré offers multimedia content across genres & formats and has won many international & domestic awards & accolades for its work in digital fiction & non-fiction. Arré Studio is also working on large-format original shows in collaboration with domestic and international OTT platforms as well as broadcast television networks. Ajay has over 2 decades of experience in media & financial services. He spent over a decade with Network18 and was Group COO and also President A+E – TV18 JV in his last held roles with the Group. He has also worked with IL&FS, Sharekhan and the Indian Express Group prior to his stint with Network18. The company’s website can be found here.

Q [to Ajay Chacko of Arré]: What are key trends today in India with respect to audiences/consumers getting content (please comment on both type of content and means of consumption/viewing (technology and price model))?:

A: The Indian digital media market has seen renewed traction ever since data prices crashed with the advent of JIO & the subsequent competitive intensity in the telecom market; the digital media audience is approaching the 400 million mark. More than (>)85% of content consumed is on the mobilewith the structure of consumption now pretty much getting aligned to what it was in the case of TV but with a different idiom i.e. audiences are watching long form shows and movies, albeit on-demand and of the kind they’d like to watch. This has also created a boom in original content commissioned by OTT platformssince TV content in India has isn’t really working when it comes to individual level consumption (remember India is a single TV household where most programming was catering to semi-urban and rural housewives since they formed the primary ratings driven chunk of viewership). The granularity of the Indian market is reflected by its languages and consumption driven by regional and national languages – these trend in the long run to be 50/50 or thereabouts (Hindi: Regional Indian languages like Bengali, Tamil, Telegu, Marathi etc.). The current roughly 800 million TV audiences which is fairly penetrated has reflected this trend and this is also showing up in digital with YouTube India reporting that almost half of its 200 million+ audience is coming from regional markets/ watching regional language content. Video market for English content is at the ‘uppermost socio-economic’ strata but it has never exceeded 4-5% of the overall pie. In fact, English TV entertainment did not cross 2% market share despite it being present in India for over two decades.

India has also been a predominantly ad-funded marketwhen it comes to even fiction/ entertainment. Currently the OTT space is 95%+ AVOD (audience numbers) and some players like Netflix, Amazon, Alt Balaji, Eros Now etc. are trying to push a subscription- based model with some degree of success. Even after 2.5 decades of the existence of cable TV with over 500 channels, India still remains a 70%+ advertising driven market and cable/ pay TV subscription packs are available for 300+ channels at less than 2.5 dollars a month.The consumption trend when it comes to the ‘pay for content’ aspect is still pretty much in the Indian idiom of being ad-driven (various models have emerged here – for example brand integrations into stories has also emerged as an important line of revenue for Independent content players as well as some AVOD platforms).

Q: What about piracy concerns and copyright infringement / protection in India?

A: Piracy has always been an issue in India though I would not put it to be the number one problem as most content in India is freely available since its ad driven/ AVOD. There are many steps being taken by industry associations to help tackle piracy when it comes to music and movies with some degree of success. Digitization has also helped in freeing the movie business from the distribution related leakages.

Q: To what extent is there an appetite / market for American independent cinema in India?

A: Like I mentioned in my earlier point, American Indie cinema has limited appeal, maybe restricted to the top tier of film-buffs etc. in terms of percentage share of the market. However, in terms numbers due to the sheer size of the market there maybe opportunities to have a couple of hundred thousand folks access these thru digital platforms/ OTT services.

Q: I hear documentaries are more popular in India than they used to be in large part due to services such as Netflix—what can you say about that?

A: Much as one would love for this to be true, it isn’t. Docs haven’t really taken off in any meaningful way and one can spend an entire day analyzing why 🙂

A couple of stray examples really don’t break this trend.

Q: Please comment about Amazon, Netflix, and Blockchain with respect to your market (India).

A: The entry of international players like Netflix, Amazon etc. has hastened the process of creation of quality original programming made for digital. This is an important breakthrough in the Indian market and a lot of the OTT platforms (who were banking on catchup tv content) now have realized that they need to up their game and come up with quality original programming in Indian and regional languages. This has thrown up a lot of opportunity for creators, film-makers who were earlier left out of the TV boom as that idiom of programming was considered regressive by most. So, I am hoping that one would see a deluge of quality original programming targeted at various demographics and geographies coming out of India in the near term. As for Arré, we are already working on over 140 hours of high-quality original shows (some for our own platform and a few in partnership with some of the domestic and international OTT players).

On Blockchain, I believe it’s a tad early, but it helps really disintermediate efficiently and this may be a boon for independent film makers and creators.

Then, I spoke to Suri Gopalanis, the Founder of Vista India Digital Media Inc., which distributes to the largest Indian studios and broadcasters with a focus on featuring films prominently on its partner platforms. Vista’s client list includes Red Chillies, Sun Network, Viacom18, Balaji Motion Pictures, Disney UTV, among others. Vista claims to be a pioneer in taking regional films on OTT platforms and having successfully delivered content in Indian languages like Marathi, Tamil, Telugu, Malayalam, Bengali, Kannada, Punjabi, Oriya, Assamese and Gujarati across all our digital platforms. The company’s website can be found here.

[Suru Gopalanis of Vista India Digital Media Inc.]: With a remarkably young population and low cost of bandwidth, the Indian market has seen explosive growth in online video. While YouTube continues to dominate AVOD, we have a hyper-competitive OTT space (both domestic and International players) operating at all the different segments. As of now, we have over 32 platformswith financial muscle fighting for a pie of the Indian market which is expected to touch $ 5 billion by 2023. While primary consumption is still on mobile devices it is expected to gravitate towards TV with dongles and apps built into TV sets.

India is a price sensitive market. With average cable bundling at less than $2.00 per month, the ability for Indian consumers to pay in comparison to International markets still remains to be proven. Having said that, there are a number of price tiers at work domestically with a mixture of AD (AVOD) and SVOD to provide maximum economic value to consumers.

India is a very diverse country with many different regional languages and audiences. The segmentation of this online is relatively easier compared to standard broadcast TV. This, in turn, is leading to a number of niche regional platforms emerging in the pay markets that are targeted via language and tastes.

Sports continues to the biggest driver both offline and online with Cricket dominating minutes watched. There has been a lot of inflows into content development as audience tastes are changing and continue to beinfluenced by what’s happening in the West.

Indian audiences have been habituated to YouTube which has grown very aggressively in India and continues to attract advertising dollars. Given the diversity of content consumption, it is little wonder that DIY content in a host of niches has found audiences on YouTube.

With so much of competition, there is a need to create differentiated content and almost all the platforms including YouTube are investing in new original shows to attract and retain eyeballs. We have seen a number of new shows which have been localized to multiple regional languages which is a new feature that OTT platforms have the advantage to experiment in.

In terms of independent features, there is not much good news. The consumption at this point appears to be to the big budget highly promoted features. Our hope is that a new generation of Indians will be more receptive to both foreign and Indian original films.

When at Film Bazaar I mentioned the launch of the Blockchain company to filmmakers and industry professionals the reaction was always extremely enthusiastic—It seems the right model for the market.…So I interviewed Nitin Narkhede, Founder & CEO of MinersINC, a new Blockchain platform/service that provides a unique opportunity to watch critically acclaimed films in India:

[Nitin Narkhede of MinersINC]: 2018 saw a progressive step forward for Indian independent cinema when Rima Das’ Village Rockstars became the country’s entry to the Oscars Best Foreign Language Film category.A passion project where Das and her school going cousins got together with a bunch of village kids to write, shoot, edit and direct this film entirely on hand held camera—Village Rockstars embodies the untapped, underutilized potential of self-trained, inspired and independent filmmakers in the country. That there is an audience for such cinema is evident to a logical mind, yet often left un-catered to by the country’s established filmmaking, distribution and exhibition segments. Das’ lilting, surreally beautiful film released in over 30 theatres in Assam and West Bengal and stayed on for over a month in very limited multiplex screens in Delhi and Bangalore, cities with sizeable and concentrated diaspora from the state. Village Rockstars had been screened at 88 film festivals, won 44 awards including four Swarna Kamals, the highest honors offered by the National Film Awards (India), to finally claim a restricted space in movie theatres.

This film elucidates aptly the absolute lack of a distribution mechanism for small, substantial and freethinking cinema or entertainment content within India. Another prime example is Mukti Bhawan, an introspective and moving film about death, old age and detachment. This film won critical acclaim in ten of the most respected film festivals, found theatrical releases in Japan and Germany, territories where familiarity with Hindi as a language is sparse.

Yet, in India, it barely found sufficient screen space- ultimately nesting on an OTT platform for viewers. Films that don’t boast of stars, celebrity filmmakers or the wizardry associated with mainstream movie making do not have a mechanism for their exhibition and distribution. Notwithstanding recognition globally, international independent films also never make it to an Indian audience’s viewing menu. With OTT platforms emerging in the country, some expected the restrictions that independent films, faced from a traditional, profit oriented distribution-exhibition system to change. Unfortunately, change for the small film, which rides on passion for a good, relevant story, is barely visible.

OTT platforms from international giants offer varied content but stay firmly focused on star-driven films and shows. English language content is also preferred by these platforms. Small, substantial films find room in a space where glitzier behemoths dominate.

Over the years, what we’ve come to firmly believe is that there is a definite audience keen on watching quality films, engaging stories from across the world here in India. With the country’s aspirational youth, levels of interest in cinema beyond typical Hollywood and Bollywood are evident. Given the challenges of access for such content, piracy often becomes a habit. Increasingly, world cinema that is shown at the film festivals, Cinefan by Osian and MAMI, based in Mumbai, runs to packed auditoriums. These films travel from across the globe, ranging from Iran, to South American nations, to East Asia and Europe. Watching them is top priority for the keen Indian cinephile today.

myNK, the OTT platform from MinersINC firmly focuses on filling this gap between demand and distribution of quality world cinema. Utilizing Blockchain technology, it ensures a safe, assured distribution platform for filmmakers to access a whole new audience that has only just begun consuming content on smart phonesand hand held devices. Currently, approximately 299 million people use smartphones in India. Over time, this number is expected to grow to 499 million as Reliance Jio expands access to high-speed data at very low prices. This is a market for movie consumption that simply has no match in terms of reach and numbers. The Hollywood Reporter has argued in a well-researched column that OTT giants like Netflix and Amazon PrimeVideo are battling it out to grow their share of the Indian video on demand market; simply because the numbers of video in India are mind boggling. In a scenario when mobile phones will often become access point for one’s personalized entertainment choices, myNK’s offering of critically acclaimed and quality world cinema offers a never before opportunity to access content for cinephiles.

Rapidly evolving digital technologies and declining costs of filmmaking equipment has led to a growth in the number of filmmakers worldwide. Rima Das, as explained, provides the perfect example. Finding an audience for these films though holds a real challenge. Additional problems that emerge are, firstly, a shortage of screens. India has just 10 screens per million people. When films don’t get released, they run the risks of getting pirated.Combined with high costs of acquiring distribution for a film often leave the film producer with no profits. Aside from this oligopolistic distribution model controlling content that makes it to a film theatre, marketing, sales and publicity for films are huge additional costs. Adding to the woes of the creator, there is a huge market of illegal downloads. Lopsides royalties and revenue distributions further reduce a creator’s earnings.

Conventional distribution mechanisms work in silos, somewhere incapacitating filmmakers and producers financially. Blockchain technology, as used by MinersINC, can help in resolving this opaque situation making a radical positive change by empowering creators in the long run. Blockchain technology naturally extends to the fundamental framework of how digital media gets distributed. It is a peer-to-peer decentralized network that brings the filmmakers in direct contact with their consumers without passing through the archaic distribution system. It gives leeway to filmmakers to bypass the costly distribution mediums and distribute their films directly to consumers. It has the potential to liberate the filmmakers by putting them back in control of their work and gives them complete autonomy on how their content gets distributed and priced. Parellely, consumers are empowered as they get the freedom to chose from a global library of films.

myNK, a product created by MinersINC envisages creating an entertainment ecosystem that will liberalize the industry from oligopolistic distribution practices, revenue dilution across middlemen, piracy, revenue leakages, copyright issues, breach of contracts, lost monetization, non-transparent earnings and unjust right attributions. Apart from addressing the current set of challenges, myNK aims at achieving greater goals by weaving the entities and components together in a fabric of trust and transparency, work on business models that make value sets more direct, less intricate and more rewarding.

In the long term, myNK aims to use blockchain technology to build an autonomous marketplace for creators to discover the real worth of their creations based on market governed dynamic pricing principals and community-driven curation. Consumers would have a significant role to play as they would act as a prudent community who will be collectively responsible for reviewing, rating, distributing, recommending and doing intelligent curation of content.

myNK empowers the creator and the consumer in Indian entertainment. Focused on bringing independent, recognized quality films from across the world, it will encourage interactions within the community, creating social media that has a definitive purpose. For those who love and live cinema, this platform is a valuable new opportunity to access worthy content while adding to a democratic, fair and collective voice for quality over hype in entertainment.

The Film Collaborative has had little or no success with its American or European indies in India but is now trying again with a curated selection to be distributed via MinersINC. Here’s hoping! And we will write again to update about changes in the India VOD market and with respect to Blockchain distribution.

Orly Ravid February 4th, 2019

Posted In: Blockchain, blockchain, Digital Distribution, Distribution, Documentaries, International Sales

Making Distribution Choices with Your Film

A recent online web series featured our founder, Orly Ravid, as well as some powerhouse guests in indie film producing and distribution, hosted by WestDocOnline. Here is what we learned from the 1 hour+ panel, primarily focused on documentaries.

- Music clearance is important. Surprisingly, many new filmmakers do not realize that any music used in a film must be licensed, both the publishing (the person who wrote the song) and the master (the entity that recorded the song) rights must be secured. Distribution contracts cannot be signed if music clearance has not been secured on your film. This is especially crucial for anyone looking to make a music documentary. For a good primer on this, visit this article: A Filmmaker’s Guide to Music Licensing .

- A devoted core fanbase can make a film successful. Richard Abramowitz named several documentaries that his company has theatrically distributed that had an excited and motivated fanbase that could be tapped into with less marketing money than a wide audience film.

- There is value in having a global marketing campaign, rather than one territory at a time. Cristine Dewey of ro*co films champions the idea that if your domestic distributor is already launching a marketing campaign, much of which will be found by audiences outside of the U.S. because of online marketing, it makes sense to time theatrical releases in other countries to coincide.

- Revenues from documentary sales. Netflix will pay anywhere from low 5 figures to high 6 or even 7 figures for documentaries. It depends on the film’s pedigree. Also, Amazon Festival Stars program was offering $200,000 to filmmakers at the Toronto International Film Festival in exchange for making Amazon Video Direct the exclusive SVOD home for the film. Filmmakers can wait up to 18 months to upload to the platform, allowing for further festival and theatrical revenue.

- Distribution is a business. While it is all great and good to produce a film using credit cards, an iPhone and the good will of your friends, distribution is an integral part of the process and needs a budget. “In what world would someone say I have a great idea for a pencil. I’m going to raise $100,000 to make pencils. Then you have a warehouse filled with pencils, and then think about how you will get these into Staples? That’s not a business plan, that’s lunacy. But every day, people do that because this is art. Hope is not a strategy. You have to have a plan and you have to have a budget,” says Richard Abramowitz. “What’s the point of making the film if no one sees it?Marketing and distribution budgeting is the only way to assure the film will get seen and make an impact, short of an excellent marketing commitment by an honest distributor, something so relatively few documentary films enjoy,” said Orly Ravid.

To watch the full panel, find it below.

Sheri Candler January 10th, 2018

Posted In: Digital Distribution, Distribution, Distribution Platforms, Documentaries, International Sales, Marketing

Tags: Cristine Dewey, film distribution, Jonathan Dana, Orly Ravid, Richard Abramowitz, roco films, The Film Collaborative