Transmedia case study-Totally Amp’d

By Sheri Candler

To coincide with 2 large events of interest to the cross platform storyteller, London’s Power to the Pixel and Los Angeles’ Storyworld Conference, I wrote up this case study of a cross platform project that was featured on the Storycode site. For the visual learners, there is a video of the presentation at the bottom of post, but it does run over an hour and a half.

Cross platform case study from Canada

Jay Bennett, VP of Digital/Creative Director, Smokebomb Entertainment, Toronto

Project: Totally Amp’d

Totally Amp’d is a mobile-only (Apple devices) series created by Smokebomb Entertainment and the first App of its kind for the underserved tween (ages 8-14) mobile entertainment market. Telling the story of five talented teenagers who are brought together to become the next big pop group, Totally Amp’d comprises a 10-appisode live-action musical comedy series, an original soundtrack, and a suite of interactive activities designed to fully immerse kids in the action.

Intent:

To make an episodic show inside of an app which would incorporate all sorts of interactive elements including music creation, movie editing and fashion design. Also, to experiment with the idea “We are the broadcaster” and see if it is possible to bypass traditional television gatekeepers and connect directly to the audience.

Funding:

Production funding came via the Canadian Media Fund Experimental Stream which supports the creation of innovative, interactive digital media content and software developed for commercial potential by the Canadian media industry or for public use by Canadians. Grant award was less than one million dollars (CAD) of which the video production budget was by far the majority of the budget, around $500K. The app technical development fell between $50-$100K. With an inhouse team this could have been lower, but they used a third party developer.

Audience demographic:

They intended the series to target 8-12 year old girls and focus on music and performance, capturing the American Idol/Glee set. Aim was to create the show for an older girl, a 14 year old, because then the 8-12 year olds will watch.

Background of the team:

Bennett came up through the ranks of digital advertising agencies conceiving and executing ARGs, puzzles and finding code in URLs to tell stories. He disagrees with that approach to storytelling because he sees himself as the average user, not someone used to looking for the magic rabbit hole in a story. He wanted the story to be more accessible through video because it is a medium the average user understands. While he believes that there are opportunities for deeper content, he would rather spend the majority of the budget on video content and much less on puzzles, games, ARG type experiences.

Smokebomb Entertainment is the digital division of Shaftesbury Productions, a leading Canadian TV producer. Totally Amp’d is their first completely original project to launch.

They brought in Karen McClellan as head writer with experience in the children’s TV market as well as writers from from the young adult market to give the scripts a more mature feel. The cast they chose played within a year of their real ages, not having 22 year olds play 17, in order to have more authenticity.

Development phase:

During research, they found a lack of good content apps aimed at the female tween demographic.

Though they started out thinking conventionally ( a webseries with some interactivity as an app), the research showed that most people now have smartphones and tablets or would have them very soon so they decided to take the whole project into the app space and viewable on a mobile device.

They only developed the project for Apple products (iPod touch, iPad, iPhone) because they felt that when people think app, they think Apple iTunes. There was a revenue incentive as well since people expect online content to be free of charge, but they don’t expect all apps to be free and they are used to paying via their iTunes account for music and other downloads. This would alleviate the need to access another way (like via credit card or Paypal) for people to pay.Since music was the major focus of the project, they brought in a professional composer who could create pop music worthy of its own release. Kids would know if they were being given “adult” music masking as teen pop and they wanted the music to be a revenue generator so it had to be top notch.

Also, they brought in a production designer to give the set a look that would be remarkable on a small screen. The result looked half real life, half cartoon, a bit like rotoscope. Elements of the set were painted on real glass plates that cost about

$2400 a piece to create, though much of the time they ended up using green screen and VFX which was even more expensive.

Thinking through each component of the app:

This an episodic show about the musical arts so possible elements to include would be music, music videos, fashion, community where kids could discuss the content together, an avatar to use in the community, game to build up points within the community, unique production design that would make the project stand out and sharability on social platforms.

But legal concerns got in the way of building a community forum because legally they needed a moderation team, especially for kids. Big broadcasters have this, but if you don’t have that support (YOU are the broadcaster, remember?), do you have the resources to do it? Also, the avatar idea was dropped because of the cost of building an avatar generating system, the game idea was dropped due to budget concerns and as was social sharing because of deadline issues and the ability of the app to handle pushing out that size of a file to a Facebook or Twitter page. Dropping social sharing was probably a mistake when it came to promotion.

Typical shoot for the video episodes:

6 days, 16 cast members, 72 shooting pages, 58 minutes of content, 10 episodes with an average of 5 minutes per episode, 2 RED cameras, 7 music videos.

The App

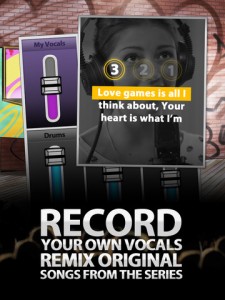

They intentionally tried to keep the app simple to use due to budget constraints and due to the age of the audience who could be as young as 5 years old. They needed something very intuitive. The app encompassed both the episodes and the activities. At the end of each episode, a new piece of video content would unlock.

There is a music studio with all the songs from the episode. One could remix the songs with a choice of different instruments, save the creations and play them back, record your own voice singing the songs so you could be the star.

There is a video studio for the music videos. There are 3 screens showing different camera angles of a video and the viewer can edit them however they want. Editing was just a series of touching the screen and the app would remember the sequence and play it back.

Finally, the design studio for the fashions. Viewer is given the blank outline of the outfit and given a choice of material patterns, colors, decorations then dress the characters from the show, a la digital paper dolls, and put them in a scene background from the show. The creations can be saved and turned into wallpapers, screen savers etc.

Deployment strategy

With file sizes like this, wifi connection is a necessity. Although putting the whole app out at once would be a huge download issue, the team thought making kids wait episode by episode would tax their patience. The file size was one gigbyte, about a 20-30 minute wait for download on iTunes.

They put out the first episode for free on Youtube, but to get the whole package, the viewer had to pay one price and it opened the whole app with all of the episodes and special content.

Deciding on a price point

Free was out of the question and 99 cents still felt like free. It would be difficult to raise the price if it started at 99 cents. For an hour’s worth of content plus the extra material, the price they settled on was $4.99. That is the median price to rent a movie on iTunes and so it would be a comfortable price point for most consumers.

Building the Audience

There was a 2 prong strategy; getting attention from the industry/technology audience and from kids/parents of kids who would actually use the app. Parents often browse the app store looking for interesting content for their kids. Since Smokebomb was the broadcaster, they had to be the promoter too.

For industry attention, they used the in house Shaftesbury Media publicity department. In the US, they used a company called One PR.

They received lots of coverage from industry press and business press.

For kids/parents attention, they enlisted the help of mommy bloggers. They did a press junket for a group of 8 influential mommy bloggers to come to Toronto to watch a shoot, see the making of the videos etc. This cost about $15000, but in hindsight they would have bought Facebook ads instead. Not that the goodwill hurt, but to spend that money to get these people to write reviews, it is likely they would have written about it for free just like any other journalist.

For social media interaction they worked with Fisheye Corporation. Tools they utilized included Facebook, Twitter, Tumblr, Youtube, own website with videos and contests.

Created 73 video assets of behind the scenes of production in order to get viewers to know the characters more intimately with backstories and explanations on using the app and what the show would be like. This was slowly dripped out in the lead up to launch.

The team released iPhone recorded videos of music recording sessions, dance rehearsals, cast doing demos of the app to show how it worked. Prize giveaways consisted of asking viewers to record themselves singing one of the songs and uploading it to the Facebook page for a chance to win. They Livestreamed the launch party on Facebook so the audience could join in and people could ask questions with the cast standing in front of the camera to answer. A street team was deployed at local pop concerts happening in Toronto with flyers promoting the show. This was all done in the lead up to launch day in order to build up audience anticipation.

Partnered with Wattpad, a young adult fiction site where amateur writers upload their stories without pay, but some writers have millions and millions of followers. They worked with 5 of the most popular writers and gave each a character from the story and had them write a backstory that did not previously exist. All the backstories led up to the first episode the viewer would see.

They promoted it on Wattpad with character videos explaining what the app was, encouraging viewers to read the backstory on Wattpad, and promoting the launch date and Facebook page.

Deployment implementation

Episode one was released for free on Youtube on Christmas Day. They released lots of teaser clips in the lead up to the first episode release. The clips were featured on AOL Kids which helped the episode reach 320K views. Official launch was January 26, 2012.

There is a risk with doing this. If the audience doesn’t like the first episode, you’ve lost them forever.

Successes

-the project actually launched, and on time

-strong press and critical praise

-industry praise from broadcasters at MIPCOM who said they beat Disney and Nickelodeon to the punch

-Disney wanted to buy the app, but Smokebomb said no because when that offer came, the project hadn’t launched yet and they wanted to see it through. Also, they would have to get agreement from each department head involved at Disney (broadcast, interactive, music etc) and that is very arduous and would take another year to sort out. Also, Disney would own it, there is no revenue share with them. In other words, you get one check and any revenue success Disney has on it (or lack thereof) belongs to Disney.

-launched to great success with fans asking for more! This was a mixed blessing because there wasn’t anything else being created in the immediate future.

Lessons learned

–Danger of the all at once release strategy

After 3 hours, the viewers had burned through all the content and wanted more. The danger in allowing binge viewing is all the build up dissipates in a short amount of time. If they had dripped out the episodes, which they hadn’t wanted to do because they felt the audience wouldn’t be patient, then they could have done more to stoke up the conversations in between episode releases and that would have taken 10 weeks to do, instead of 3 hours. As it was, the audience ate up all the episodes and then were gone to the next thing.

–Danger of the file size

Since the app was 1 gig and had a 30 minute download time, some may have given up before the download finished.

–Being the megaphone

In doing this without a broadcaster’s support, it is exceedingly difficult to reach millions and millions of people on your own, only a fraction of whom will actually buy and download. Undeniably, once the initial launch efforts were finished, the download count dropped. People are still downloading, but nowhere near what they were at the start. This is all down to having a strong and sustained publicity effort going. Once the promotional budget was spent and efforts ceased, the buying went down.

–Selling the rights in other territories

[editor’s note: I know many creators count on the revenue stream they are sure to get from broadcasters/distributors] No broadcaster cares about buying the rights to 10 episodes of a webseries. They will only get 10 weeks out of it on TV and then the show is finished. They don’t want to work at building an audience for only 10 episodes, they want 100 episodes. Same for selling broadcast TV syndication, you can’t sell a show with less than 3 seasons.

Axing the social sharing capability

By axing the social sharing due to budget, they also disabled the ability for free messaging by the viewers to spread their efforts wider. The purpose of social networking is sharing content you are excited about and they didn’t enable an easy way to do that. People did find a way around it, but it could have been done more easily.

Next steps based on those lessons

-Perhaps strip out the episodes and put them online for free to build the widest audience possible. Once you have that large audience, find opportunities to sell either advertising or to a broadcaster who will commission more episodes. [editors note: while this theoretically could work, many, many Youtube channels are already devoted to doing this and very few have accomplished it].

-Perhaps keep the interactivity portions to sell as an app, making the app shorter to download and cheaper, like 99 cents. With many more people watching, it is a much bigger pool of people to ask to buy a 99 cent download app.

-Extend the experience without making new content, new shows, because the production fund is spent so there is no money to make anything new. Perhaps they could build a website as a portal to discovery of other content already available online. Examples: existing unknown bands with the same music sensibility as the show and highlighting them; calls for UGC content as well.

-Look at this project as a pilot for TV or web series for a broadcaster. Truthfully, broadcasting is still where the audience is in a mass way. Are there viral hits on Youtube, yes a few, but the mass audience isn’t consistently on Youtube yet. The ultimate goal is TV, mobile, games, live event, the whole package.

Questions to consider

-How do you create an app that massively catches on when tons of people are creating new things and uploading them every day?

-Once your app is found, how do you keep people engaged from week to week? What mechanisms are you creating to keep your project top of mind?

Thanks to Jay Bennett for being candid about Smokebomb’s process and outcomes. For the video of his presentation including the post Q&A session, watch this

Sheri Candler October 16th, 2012

Posted In: transmedia

Tags: American Idol, app, Apple, ARG, audience building, Canadian Media Fund, Glee, iPad app, Jay Bennett, Power to the Pixel, Shaftesbury Productions, Storycode, Storyworld Conference, Totally Amp'd

Subtitles in Digital America

Recently I was invited to be on a panel at the International Film Festival Rotterdam (IFFR) and participate in their mentoring sessions and the lab at Cinemart. Great experience. I am always amazed by the difference between the US and Europe. The whole government funding of films and new media initiatives as our government is about to shut down. Well, their policies and practices do take their own financial toll too but one I think is worth it. For all my europhileness I have to note that the Europeans can be just as guilty of not wanting to watch subtitles in fact some countries dub films instead. And of course we know that Hollywood is big business in Europe too. But all in all, art house cinema seems to reach more broadly in Europe and even some parts of Asia than it does in the US. Films in Cannes and other top fests can sell all over Europe and never in the US or success in opening theatrically only in NY and maybe LA and overall it seems to me box office is generally down for foreign language cinema.

International filmmakers want US distribution and it was painful for me to discuss their prospects at IFFR because for so many, the prospects are slim. But this one’s for you! (Please note this blog is focused on digital distribution and not healthy categories for foreign language cinema such as Non Theatrical including Museums, Films Festival, Colleges, Educational / Institutional).

Cable VOD was 80% of the digital revenue in the US in 2009 but it’s now declining little by little, now estimated to be in the high 70’s (approx 77%) and may decline further still. The reason for this change, which is expected to continue, is that Internet based platforms are growing. Regarding FOREIGN LANGUAGE ON CABLE VOD: Distributors and aggregators agree that foreign language cinema is very hard to get onto Cable VOD platforms and slots for non-English cinema are reserved generally for marquee driven films and/or films with a real hook (name cast/director, highly acclaimed, genre hook). A big independent Cable VOD aggregator notes a real struggle in getting foreign language films to perform on Cable VOD and even Bollywood titles that had wide theatrical distribution and a box office of upwards of $1,000,000 still perform poorly (poorly means 4-figure revenue, 5-figure tops). They have had some success with foreign martial arts films and will continue with those in the foreseeable future. Time Warner Cable (TWC) remains more open to foreign language cinema though it plays the fewest films, a range between 190 – 246 at any given time (with a shelf life usually of 60 days and with 2/3rd of the content seeming to be bigger studio product, and the rest indie). By comparison Charter and AT&T play about 1,000 and Verizon plays 2,000, and Comcast plays about 4,000. [See below for the 2010 breakdown of Cable subscription numbers.] Hence, individual titles may perform better on Time Warner Cable for obvious reasons, Comcast may have more subscribers but there’s less competition and TWC is in New York, the best demographic for art house cinema.

Generally speaking, platforms overall are far more receptive to foreign films following the recent success of DRAGON TATTOO, TELL NO ONE, IP MAN, etc. than they have ever been before. However as one can see from the titles noted, foreign genre films are preferred because they have the opportunity to reach broader audiences than the usual foreign film. Genres that reportedly work include: sci-fi, thriller/crime, action, and sophisticated horror. Dramas have had limited success, and comedies often don’t translate, nor does most children’s content. In regard to Cable VOD – foreign box office is becoming an important proxy, because the marketing and pr tend to build US awareness on the larger titles prior to being available here. Many companies have built very successful VOD businesses pursuing a day and date theatrical or DVD strategy. Again, genre films work best, with horror and sci fi being the top performers. 3 of the top 10 non-studio titles in 2010 were foreign language subtitled releases. Small art house distributors say that at most it’s a small dependable revenue stream via services such as INDEMAND http://www.indemand.com (iN DEMAND’s owners are and it services Comcast iN DEMAND Holdings, Inc., Cox Communications Holdings, Inc., and Time Warner Entertainment – Advance/Newhouse Partnership.) Distributors and aggregators all site Time Warner as being far more open to foreign language cinema than Comcast, because it’s urban focused (NY, LA, etc) not heartland focused as Comcast is.

In terms of these titles finding their audiences on Cable VOD, Comcast announced improved search functionality by being able to search by title and Cable VOD is aware of its deficiencies and is said to be improving in terms of marketing to consumers but Cable VOD is still infamous for its lack of recommendation engines and discovery tools. Key aggregators work to have films profiled in several categories and not just the A-Z listing.

Top 25 Multichannel Video Programming Distributors as of Sept. 2010 – Source NCTA (National Cable Television Association)

| Rank | MSO | BasicVideoSubscribers |

| 1 | Comcast Corporation | 22,937,000 |

| 2 | DirecTV | 18,934,000 |

| 3 | Dish Network Corporation | 14,289,000 |

| 4 | Time Warner Cable, Inc. | 12,551,000 |

| 5 | Cox Communications, Inc.1 | 4,968,000 |

| 6 | Charter Communications, Inc. | 4,653,000 |

| 7 | Verizon Communications, Inc. | 3,290,000 |

| 8 | Cablevision Systems Corporation | 3,043,000 |

| 9 | AT&T, Inc. | 2,739,000 |

| 10 | Bright House Networks LLC1 | 2,194,000 |

| 11 | Suddenlink Communications1 | 1,228,000 |

| 12 | Mediacom Communications Corporation | 1,203,000 |

| 13 | Insight Communications Company, Inc. | 699,000 |

| 14 | CableOne, Inc. | 651,000 |

| 15 | WideOpenWest Networks, LLC1 | 391,000 |

| 16 | RCN Corp. | 354,000 |

| 17 | Bresnan Communications1 | 297,000 |

| 18 | Atlantic Broadband Group, LLC | 269,000 |

| 19 | Armstrong Cable Services | 245,000 |

| 20 | Knology Holdings | 231,000 |

| 21 | Service Electric Cable TV Incorporated1 | 222,000 |

| 22 | Midcontinent Communications | 210,000 |

| 23 | MetroCast Cablevision | 186,000 |

| 24 | Blue Ridge Communications1 | 172,000 |

| 25 | General Communications | 148,000 |

FOREIGN LANGUAGE CINEMA VIA OTHER DIGITAL PLATFORMS and REVENUE MODELS:

DTO (Digital Download to Own (such as Apple’s iTunes which rents and sells films digitally) – this space has been challenging for foreign films in the past, and most services do not have dedicated merchandise sections. Thus, the only promo placement available is on genre pages, so the films need to have compelling art and trailer assets to compete. iTunes and Vudu (now owned by WALMART – see below) are really interested in upping the ante on foreign films over the next 12 months. Special consideration will need to be made for the quality of technical materials, as distributors have encountered numerous problems making subtitled content work on these providers.

SVOD (Subscription VOD such as NETFLIX’s WATCH INSTANTLY) – this space is probably the best source of revenue for foreign content because the audience demos skew more sophisticated and also end users are more inclined to experiment with new content niches. Content in this space should have great assets and superior international profile (awards, box office), and overall should evoke a “premium feel” for the right titles, license fees can be comparable to high end American indies. Appetite for foreign titles will increase as the price for domestic studio content continues to accelerate. Genres are a bit broader than VOD/DTO, but thrillers, sci fi and action still will command larger sums ($). Good Festival pedigree (especially Cannes, Berlin, Venice, Sundance, etc.) will also command higher prices. Overall, it’s a great opportunity as long as platforms keep doing exclusive deals. NETFLIX has surpassed 20,000,000 subscribers and a strong stock price and is in a very competitive space and mood again. (See more below). Hulu expects to soon reach 1,000,000 subscribers “to approach” half a billion in total revenues (advertising and subscription combined) in 2011, up from $263 million in 2010. That’s from $108 million in 2009. (see more below)

AVOD (Advertising Supported VOD – such as SNAG and HULU) – Another great space for foreign content (as evidenced by the recent exclusive HULU – Criterion deal – (see below) although that deal is actually for HULU’s subscription service (Hulu Plus). These platforms are more willing to experiment with genres and content types and favor art films and documentaries over genre films. Depending on the film, annual revenues can approach low to mid four (4) figures in rev share. SNAG recently was capitalized to the tune of $10,000,000 but seems to be spending that money on marketing and not on “acquiring” so a film’s revenue is likely to be dependent on performance and rev/share unless one strikes an exclusive deal with SNAG and manages to get an MG. HULU’s revenues are covered above. Films report low 4-figures but sometimes 5 and 6 figure revenues but up until now those higher performing films have been English language and appeal to younger males.

TELEVISION / BROADCAST SALES: For foreign language cinema unless one has an Oscar™ winner or nominee, or an output deal, the prospects of a meaningful license fee are slim. Even worse, if you do secure a deal, it will likely preclude participation in Cable VOD, Netflix and any of the ad-supported VOD platforms such as Hulu and Snag.

KEY SPECIFIC TOP SPECIFIC DIGITAL PLATFORMS / RETAILERS:

AMAZON reportedly is readying a service that would stream 5,000 movies and TV shows to members of its $79-per-year Prime free-shipping membership program. Amazon being corporately tied to extremely popular entertainment information service IMDB and the film festival submission service WITHOUTABOX gives it a potential edge in the market, one that has never been fully harvested but easily could be and seems to be looming. And since its inception, Amazon has let film content providers open up shop on their site directly without a middle-man. Middle man aggregators get slightly better terms. Amazon presently offers 75,000 films and television shows combined and plans to soon exceed 100,000. It should be noted Amazon VOD has been US-focused though recently bought Love Films in the UK.

FOCUS FEATURES’ NEW DIGITAL DISTRIBUTION INITIATIVE: There is not much information out on this yet but FOCUS/UNIVERSAL are launching a new digital distribution initiative that may or may not brand their own channel on iTunes etc., but does seem to be focused on niche cinema to some extent and this may speak to foreign language titles. An option to watch out for.

GOOGLE is working on encroaching into the content delivery market with its launch of GOOGLE TV, which unfortunately has not created quite the fanfare the company planned for. It boasts: The web is now a channel. With Google Chrome and Adobe Flash Player 10.1, Google TV lets you access everything on the web. Watch your favorite web videos, view photos, play games, check fantasy scores, chat with friends, and do everything else you’re accustomed to doing online. GOOGLE TV does come with the Netflix App and others. Google partnered with some of the leading premium content providers to bring thousands of movie and TV titles, on-demand, directly to your television. Amazon Video On Demand offers access to over 75,000 titles for rental or purchase, and Netflix will offer the ability to instantly watch unlimited movies and TV shows, anytime, streaming directly to the TV.

HULU: Hulu’s numbers keep growing for certain films, which has to-date not been foreign language but that may change given the Criterion Collection announcement. Hulu is also now a subscription service (HULU PLUS) and announced the Criterion deal is for that. Criterion of course specializes in classic movies from the canon of great directors–Ingmar Bergman, Jean-Luc Godard, Federico Fellini, etc.–and has about 800 titles digitized so far, many of which are also available via Hulu competitor Netflix. It’s understood that this will be an exclusive deal, and that the Criterion titles that Netflix does offer will expire this year. Hulu Plus subscribers will initially get access to 150 Criterion films, including “The 400 Blows,” “Rashomon” and “Breathless.” Hulu says the movies will run without ad interruptions, but may feature ads before the films start; the free Hulu.com service will offer a handful of Criterion titles, which will run with ads. Hulu, owned by Comcast’s NBC, Disney’s ABC and News. Corp.’s Fox introduced the Hulu Plus pay service last year. Hulu CEO Jason Kilar says the $7.99-per-month offering is on track to reach one million subscribers in 2011. Competing for exclusive content seems to be on the rise as platforms compete for household recognition and top market share.

iTunes (APPLE): iTunes dominated consumer spending for movies in 2010 but that may not last long. One can get onto iTunes via one of its chosen aggregators such as New Video, IODA, Tune Core, Quiver… Home Media Magazine reported the findings of an IHS Screen Digest report that showed that Apple was able to hold off challenges from competitors like Microsoft’s Zune Video (via XBOX Kinect), Sony PlayStation Store, Amazon VOD and Walmart’s VUDU. Despite the new competition, the electronic sellthrough and video on demand market rose more than 60% in 2010, Apple iTunes still came out on top, perhaps due in part to the release of the iPad last spring and Apple TV last fall. Research director of digital media for IHS, Arash Amel, said, “The iTunes online store showed remarkable competitive resilience last year in the U.S. EST/VOD movie business, staving off a growing field of tough challengers while keeping pace with a dramatic expansion for the overall market.” However, it’s important to note that although iTunes staved off competition, the overall iTunes consumer spending fell almost 10% in 2010 to 64.5%. It was 74.4% in 2009. Insiders predict it will not hold its market dominance for long.

Microsoft’s Zune Video was one of Apple’s biggest competitors last year, accounting for 9% of U.S. movie EST/iVOD consumer spending in 2010 but this does not seem a key platform for foreign language cinema.

MUBI: www.Mubi.com having added Sony Playstation to its platforms reach, MUBI now has reportedly 1,200,000 members worldwide and is finally in a better position to generate revenue. Still its own figures estimates amount to 4-figures of revenue and that’s for all its territories. Mubi’s partnership with SONY does not extend into the US.

NETFLIX as reported in Multichannel News “as its subscriber base has swelled, Netflix has become a target for critics complaining that it is disrupting the economics of TV” is now a competitor to Cable and in fact Cable VOD companies won’t take a film if it’s already on NETFLIX’s Watch Instantly service. But Netflix is realizing it erred by losing focus on the independent and is now quietly offering bigger sums that compete with Broadcast offers and that are on par with the 5 and 6 figure revenues generated by Cable VOD for the stronger indie / art house films. Having films exclusively may be the driving force of future monetization in digital, or least in SVOD. Regarding 2011 outlook, Netflix’s “business is so dynamic that we will be doing less calendar year guidance than in the past,” the execs said. For the first three months of the year, Netflix expects domestic subscribers to increase to between 21.9 million and 22.8 million, with revenue between $684 million and $704 million and operating income between $98 million and $116 million. Internationally — meaning, for now, Canada — the company expects 750,000 to 900,000 subscribers with revenue of $10 million to $13 million and an operating loss between $10 million and $14 million.

REDBOX: Redbox, whose brick-red DVD vending machines are scattered across the country, is aiming to have a Netflix-like video streaming subscription service up and running by the end of 2011, company executives told investors mid February. Redbox is a wholly owned subsidiary of Coinstar. The Oakbrook Terrace, Ill.-based company claims to have rented more than 1 billion DVDs to date through vending machines at about 24,900 U.S. locations nationwide, including select McDonald’s, Wal-Mart Stores and Walgreens locations. It should be noted though that Redbox is very studio title focused and wide release focused but its streaming service will likely move beyond that.

WAL-MART bought VUDU and is expected to be a major player. Walmart is the world’s largest retailer with $405 billion in sales for the fiscal year ending Jan. 31, 2010. In the U.S., Wal-Mart Stores, Inc. operates more than 4,300 facilities including Walmart supercenters, discount stores, Neighborhood Markets and Sam’s Club warehouses. VUDU, is Walmart’s recently acquired online media source where consumers can rent or buy movies and TV shows for their internet-ready HDTV, Blu-ray Disc players or PlayStation 3 consoles. Like iTunes, there are no monthly fees. Consumers can buy and rent movies when they want, and 2-night rentals are only $2. It will be interesting to see how VUDU will rise as a contender in 2011 and whether iTunes will suffer as a result of their success. Wal-Mart advertises that regarding VUDU: “from Internet-ready HDTVs to WiFi enabled Blu-ray players, you’ll find all the VUDU ready electronics you’re looking for at Walmart.com. Whether adding a flat panel TV to your dorm room or upgrading your home entertainment center, our selection of VUDU ready HDTVs has you covered. You’ll also save money on our VUDU ready products when you select items with free shipping to your home. With VUDU, you’ll be able to stream HD movies directly from the Internet to your TV in dynamic surround sound for a great low price. Shop VUDU ready HDTVs and Blu-ray players at Walmart.com — and save. “ And the retail giant makes sure all relevant devices / electronics it carries are VUDU-enabled. 2011 and beyond will be telling. Wal-Mart caters to the average American so it remains to be seen if there is an appetite for foreign language film via VUDU in the months and years to come. In its inception VUDU was catering to early adaptors of new technology and those eager to watch HD but now it seems to be becoming more generic. New Video is a preferred aggregator to VUDU, among others.

VODO (Free / monetized Torrent): www.VODO.net: This has not been tried in the US by most distributors if any and not for foreign language cinema but it has worked for several projects such as Pioneer One which generated $60,000 USD by having the content made available for free and then getting donations in return.

Other emerging retailers entering the digital space:

Sears and Kmart are the latest over-the-top threats to pay-TV providers’ video-on-demand businesses. Sears launched its online movie download service, Alphaline Entertainment, which will let Sears and Kmart customers rent or purchase movies, including on the same day they are released on DVD and Blu-ray Disc, provided through digital media services firm Sonic Solutions. Titles currently available to rent or buy from Alphaline include studio and successful TV shows. Under Sonic’s multiyear agreement with Sears, the companies will provide access to Alphaline services through multiple devices including Blu-ray Disc players, HDTVs, portable media players and mobile phones. Sears and Kmart, said in a statement. “We’ll continue to increase the reach and flexibility of the Alphaline Entertainment service by providing consumers on-demand access to the latest entertainment from a range of home and mobile electronics.” Sears, which merged with Kmart in 2005, is the fourth largest retailer in the U.S. The company has about 3,900 department stores and specialty retail stores in the U.S. and Canada. It remains to be seen if they take on foreign language cinema. New Video is also an aggregator to them.

That’s all she wrote folks. Until the next time.

Orly Ravid March 10th, 2011

Posted In: Amazon VOD & CreateSpace, Digital Distribution, Distribution, Distribution Platforms, Hulu, International Sales, iTunes, Netflix, Uncategorized

Tags: Alphaline Entertainment, Amazon, Apple, AVOD, Cinemart, Comcast, Digital Distribution, DTO, film distribution, Focus Features, foreign language film, Google TV, Hulu, InDemand, International Film Festival Rotterdam, iTunes, Kmart, Microsoft Zune, Mubi, Netflix, New Video, PioneerOne, Redbox, Sears, SnagFilms, subtitles, SVOD, Time Warner, VOD, VODO, VUDU, Walmart